Include Tax Classes in Deposit Policies

Stay is enhanced to allow users to choose to include the tax classes available for a property when creating or modifying deposit policies for reservations and groups.

Feature Setting

The following new feature setting must be enabled to use this feature.

-

Name: Enhance Tax Classes for Deposit Policy

-

Value: License is not required

The Enhance Tax Classes for Deposit Policy feature setting is enabled by default for all properties.

When this feature setting is enabled, users can include or exclude tax classes as part of deposit policy configuration. When disabled, users cannot view the tax classes when configuring deposit policies.

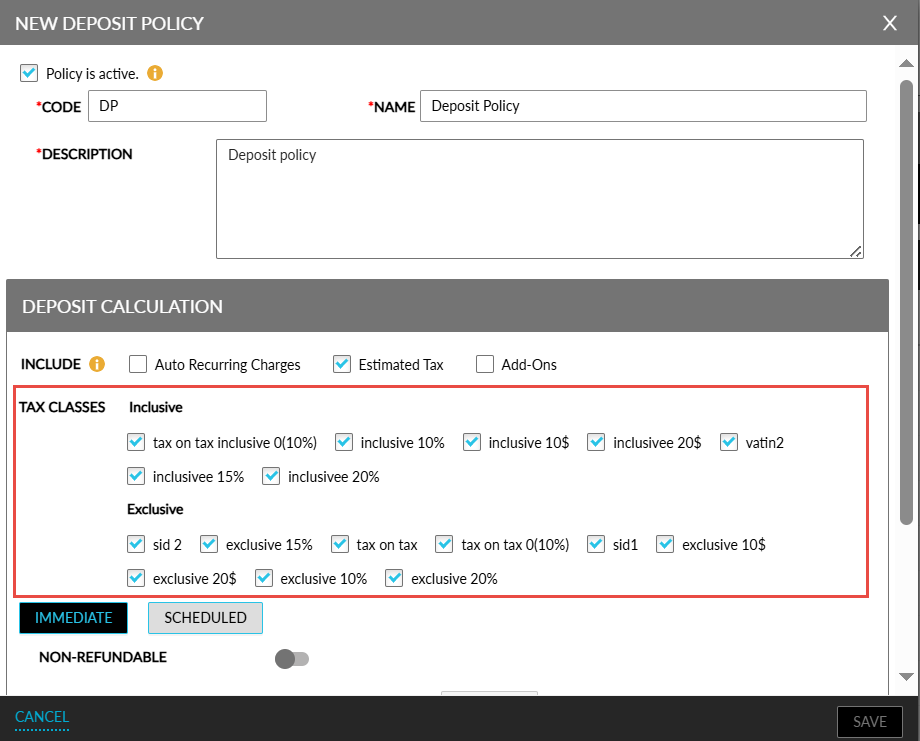

Reservation Policies

When users create new deposit policies for reservations in the New Deposit Policy pop-up screen (All Settings ➜ Reservations ➜ Policies & Codes ➜ Deposit Settings ➜ Reservation Policies ➜ Add) or modify an existing policy in the Edit Deposit Policy pop-up screen, tax classes can be included in the policy by selecting the Estimated Tax checkbox. When selected, a new label, Tax Classes, appears that displays all the inclusive and exclusive tax classes available for the property, selected by default.

Users can deselect the tax classes that are not applicable for the deposit policy.

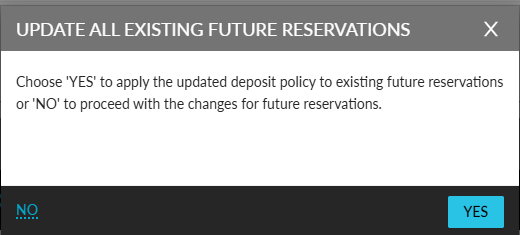

When users modify the tax classes selected for a deposit policy created previously and click Save, a new pop-up screen, Update All Existing Future Reservations, appears that prompts users to confirm if the updated policy must be applied to the existing future reservations with which the policy is associated.

-

When users click Yes, the updated policy is applied to all existing future reservations.

-

When users click No, the updated policy will be applied only to new reservations created using the policy.

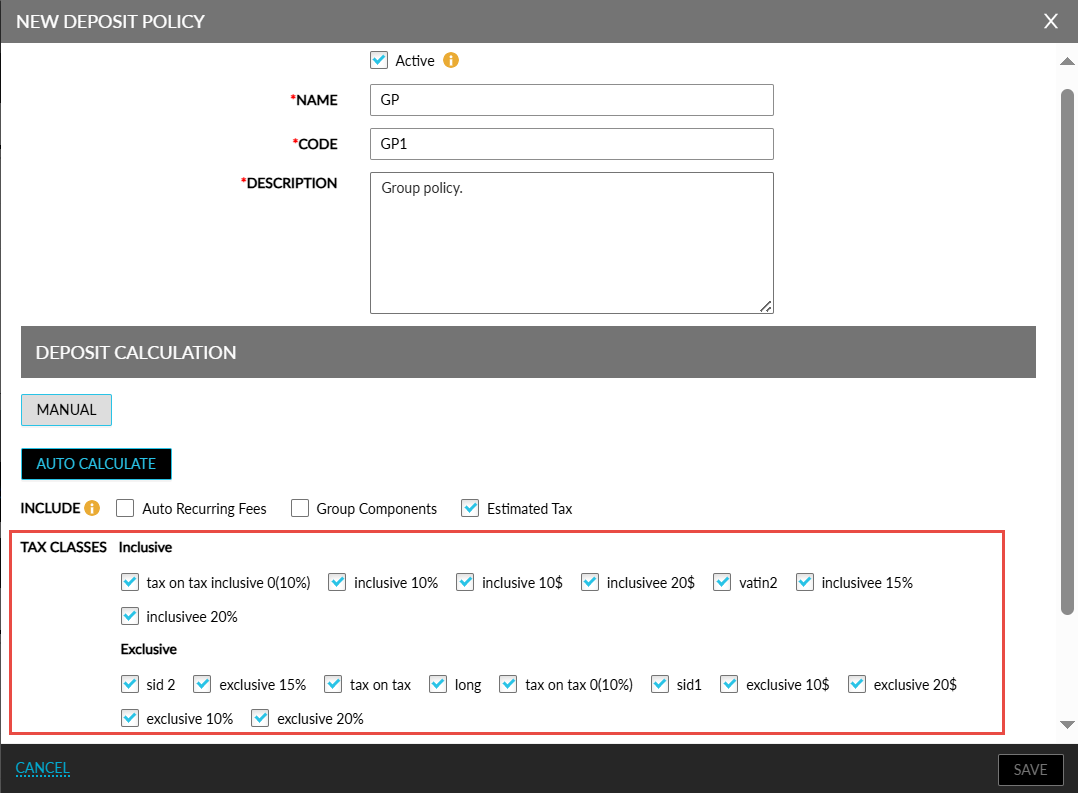

Group Deposit Policies

When users create new deposit policies for groups in the New Deposit Policy pop-up screen (All Settings ➜ Reservations ➜ Policies & Codes ➜ Deposit Settings ➜ Group Policies ➜ Add) or modify an existing policy in the Edit Deposit Policy pop-up screen, tax classes can be included in the policy by selecting the Estimated Tax checkbox.

When selected, a new label, Tax Classes, appears that displays all the inclusive and exclusive tax classes available for the property, selected by default.

Users can deselect the tax classes that are not applicable for the deposit policy.

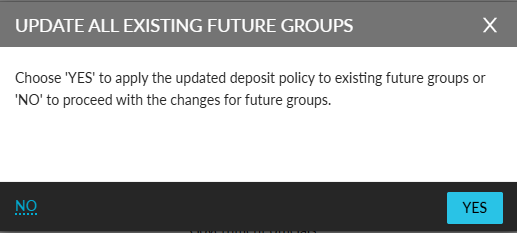

When users modify the tax classes selected for a deposit policy created previously and click Save, a new pop-up screen, Update All Existing Future Groups, appears that prompts users to confirm if the updated policy must be applied to all existing future groups with which the deposit policy is associated.

-

When users click Yes, the updated policy is applied to all existing future groups.

-

When users click No, the updated policy will be applied only to new groups created using the policy.

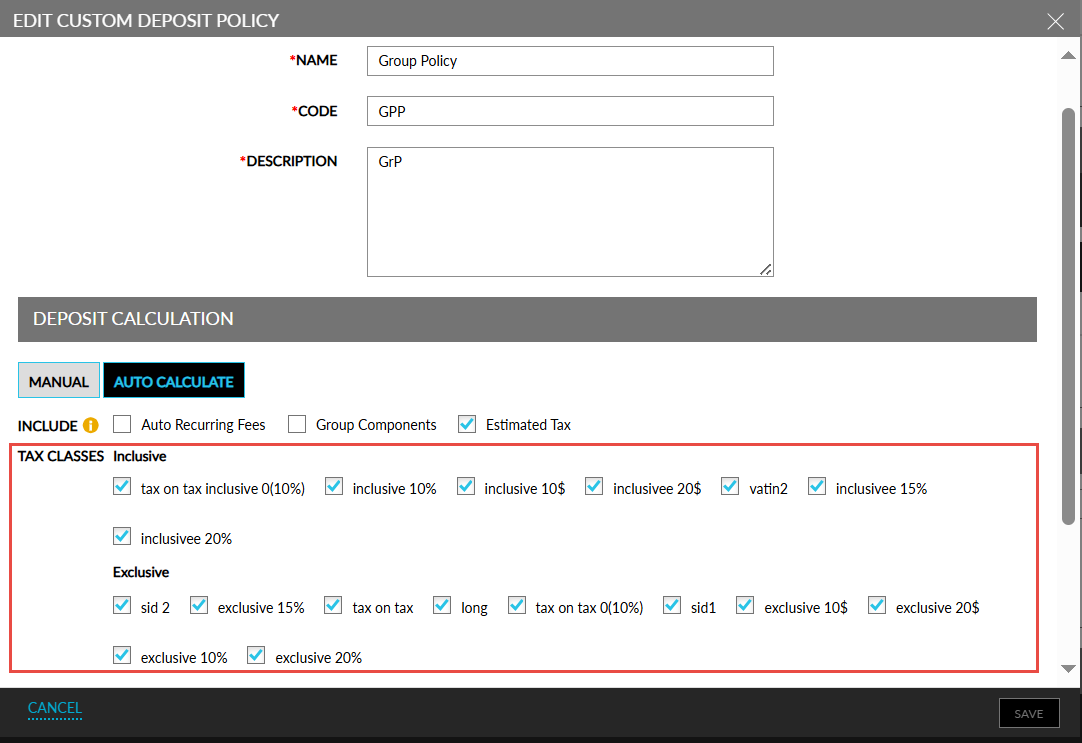

Custom Deposit Policy for Groups

When users create a new custom deposit policy for a group in the New Custom Deposit Policy pop-up screen (Group ➜ Group Booking ➜ Deposit ➜ Custom Deposit Policy ➜ Add) or modify a previously created policy in the Edit Custom Deposit Policy pop-up screen, tax classes can be included in the policy by selecting the Estimated Tax checkbox.

When selected, a new label, Tax Classes, appears that displays all the inclusive and exclusive tax classes available for the property, selected by default.

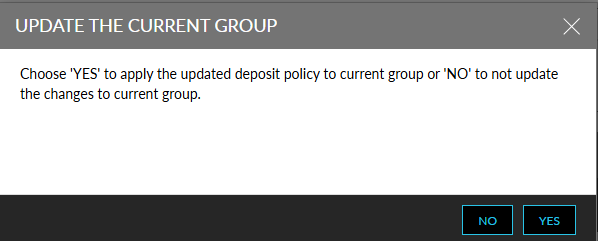

Users can deselect the tax classes that are not applicable for the deposit policy. When users modify the tax classes selected for a deposit policy created previously and click Save, a new pop-up screen, Update the Current Group, appears that prompts users to confirm if the updated policy must be applied to the current group.

-

When users click Yes, the updated policy is applied to the current group.

-

When users click No, the updated policy is not applied to the current group.

The following table lists the various scenarios in which a deposit policy is modified:

|

Scenario |

Description |

|---|---|

|

Deposit amount is modified, and taxes are added/removed |

The base deposit amount of existing future reservations will not be modified, but the taxes will be added/removed from the reservations. |

|

Deposit amount is modified but taxes are not modified |

There will be no impact to existing future reservations. |

|

Auto recurring charges are added/removed, and taxes are added/removed |

Auto recurring charges will not be added/removed to existing future reservations. Only taxes will be added/removed from the reservations. |

|

Auto recurring charges are modified but taxes are not modified |

There will be no impact to existing future reservations. |

|

Add-on charges are added/removed, and taxes are added/removed |

The base deposit amount of existing future reservations will not be modified, but the taxes will be added/removed from the reservations. |

|

Add-ons are modified but taxes are not modified |

There will be no impact to existing future reservations. |

|

Deposit policy is modified from Immediate to Scheduled and taxes are added/removed |

The base deposit amount of existing future reservations will not be modified, but the taxes will be added/removed from the reservations. |

|

Scheduled deposit policy is modified, and taxes are added/removed |

The base deposit amount of existing future reservations will not be modified, but the taxes will be added/removed from the reservations. |

|

Scheduled deposit policy is modified but taxes are not modified |

There will be no impact to existing future reservations. |

|

Scheduled deposit policy is modified as Immediate policy and taxes are added/removed |

The base deposit amount of existing future reservations will not be modified, but the taxes will be added/removed from the reservations. |

Reports

The deposit amount collected is displayed in the following Dynamic reports:

-

Deposit Due

-

Deposit Failure

-

Advance Payment/Deposit

-

Lost Business Tracking